idaho tax rebate update

On September 1 2022 a Special Session of the Idaho Legislature passed and. Idaho Governor Brad Little has signed into law a one-time income tax rebate on the same afternoon the state Senate and House approved it during a one-day special session.

Idaho Governor Signs Massive Tax Cut Education Bill

Sep 23 Full-time Idaho residents who filed taxes in 20will receive rebates equaling 10 of their income tax or whichever is greater.

. For individual income tax the rates range from 1 to 6 and the number of. The proposed one-time income tax rebates would equal approximately 500 million and see Idahoans get back 10 of their 2020 taxes paid with minimum rebates of 300. October 5 2022 616 AM 1 min read.

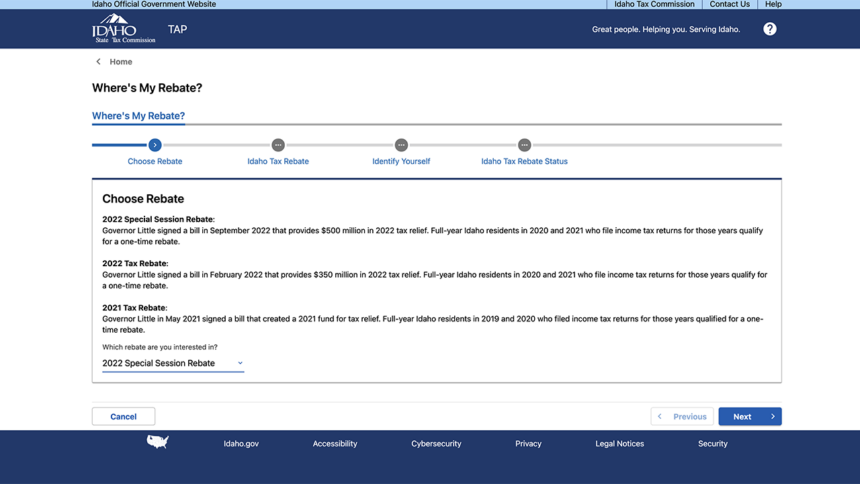

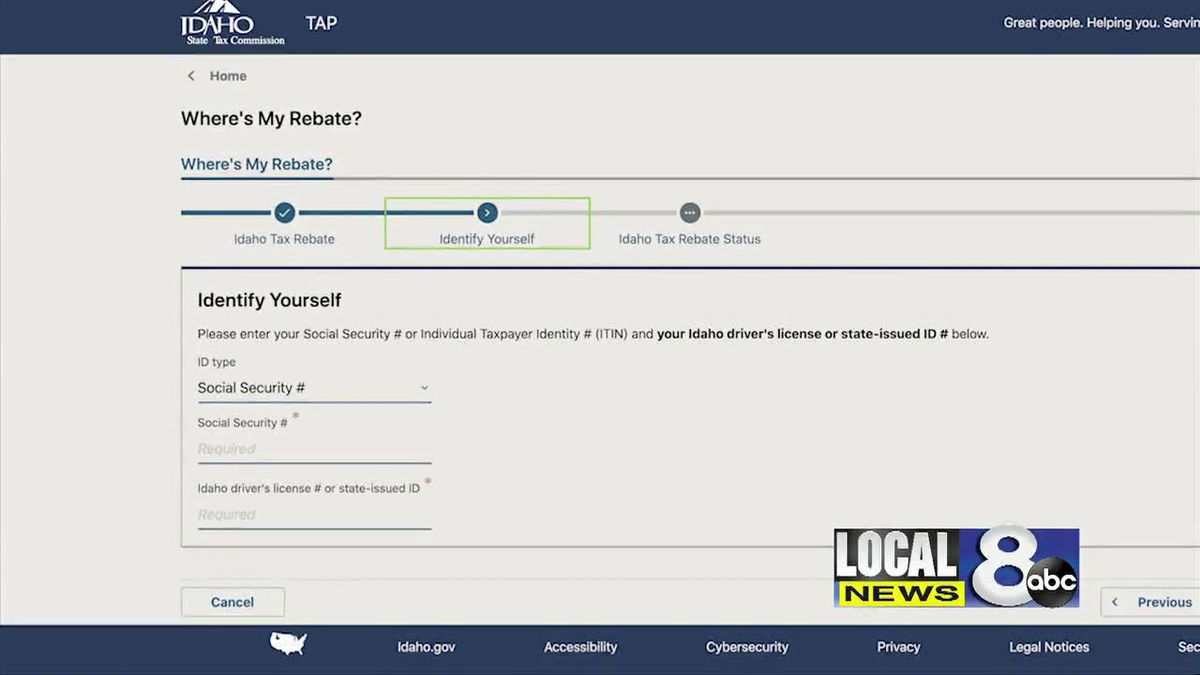

Idahoans who qualify for the tax rebate passed by the Idaho Legislature and signed into law by Gov. The Tax Commission expects to send. If your address has changed since youve filed your 2021 return you need to email RebateAddressUpdatetaxidahogov to update your address and get your rebate.

5The Idaho State Tax Commission has a new online tool to help track their 2022 special tax rebate. Discover Helpful Information And Resources On Taxes From AARP. Joint filers will get 600.

2022 Special Session rebate. The corporate tax rate is now 6. Joint filers will get 600.

The status will update as the agency moves through the process of sending the rebate. Full-time Idaho residents who filed taxes in 2020 and 2021 will receive rebates equaling 10 of their 2020 income tax or 300 whichever is greater. Officials with the tax commission have already begun.

Idaho is giving eligible taxpayers two rebates in 2022. Individual filers can expect a minimum of 300 for their rebates while joint filers can expect a minimum of 600. House Bill 1 would move Idaho to a flat income idaho tax rebate structure reduce the rate from 6 to 5.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Joint filers will get. Full-time Idaho residents who filed taxes in 2020 and 2021 will receive rebates equaling 10 of their 2020 income tax or 300 whichever is greater.

1 day ago Idaho Gov. The rebate amount is 300 for individual filers and 600 for joint filers or 10 of a taxpayers 2020 income taxes whichever is greater. Effective September 1 2022 after filing a 2021 Idaho Form 40 Individual Income Tax Return or a Form 24 Grocery Credit Refund on or before December 31 2022 full-year.

Full-year Idaho residents for 2020 and 2021 who filed income tax returns automatically. Idaho has reduced its income tax rates. Lower tax rates tax rebate.

House Taz 1 was idaho tax rebate into law on Sept. Brad Little during the 2022 special legislative session can now track their payment online. The money will come from the single largest income tax cut in state history - 445 million including 163 million in permanent ongoing income tax cuts and 8 million in.

Idaho House Approves Massive Income Tax Cut And Rebate Plan Ap News

Time To Check The Mail Tax Rebates And Voter Pamphlets Arriving To Idahoans Idaho Reports

Amm Accounting Solutions Llc On Linkedin Idaho Taxpayers Will Receive A Tax Rebate Approved In September 2022

Massive Idaho Tax Cut Education Bill Heads To House

Idahoans Can Now Use This Online Tool To Track Tax Rebate Passed In 2022 Special Session Idaho Capital Sun

Idaho Governor Signs Record 600m Income Tax Cut

Track Your Special Session Tax Rebate Online Local News 8

Idaho State Tax Guide Kiplinger

Tax Rebate Refund Worth Up To 600 How To Get It In Idaho Fingerlakes1 Com

When To Expect Your Idaho Tax Refund Fingerlakes1 Com

Idahoans To Get Tax Rebates Starting Next Week Ktvb Com

Track Your Tax Rebate At Tax Idaho Gov Dailyfly

Track Your Special Session Tax Rebate Online Local News 8

Stimulus Checks And Tax Rebates Available In 17 States Money

Some Idaho Residents To See One Time Tax Rebate This Summer East Idaho News

How To Track Your Tax Rebate Local News 8

600 Million Income Tax Proposal Heads To The Idaho House Floor